5 reasons to automate your factoring back office - Klippa

Por um escritor misterioso

Last updated 22 setembro 2024

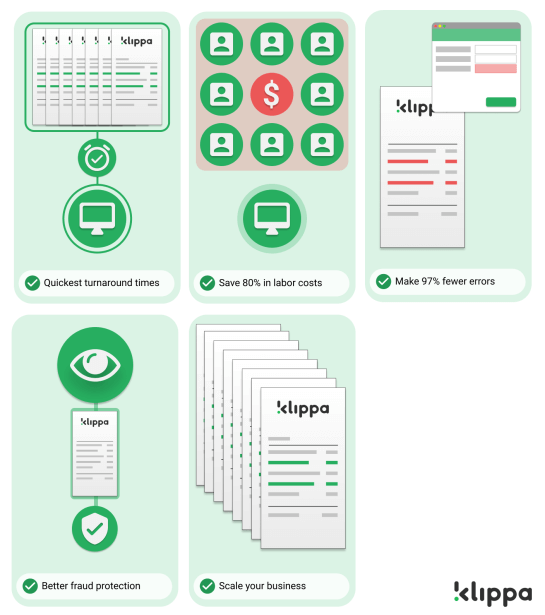

Faster data entry, lower costs, fewer mistakes and less fraud. Learn about the top 5 reasons to automate your factoring processes »

What is KYC in Banking and Why Does it Matter? - Klippa

What is KYC in Banking and Why Does it Matter? - Klippa

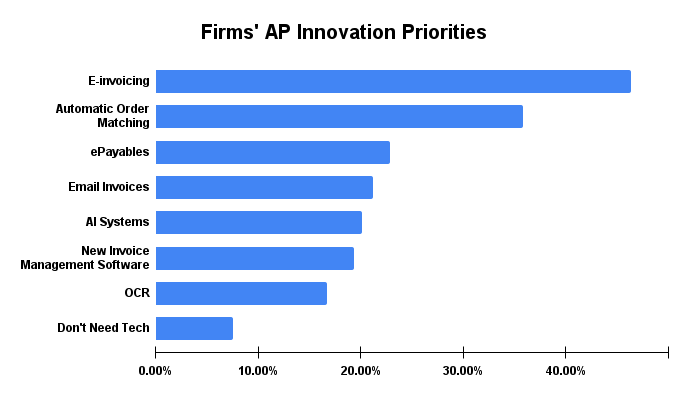

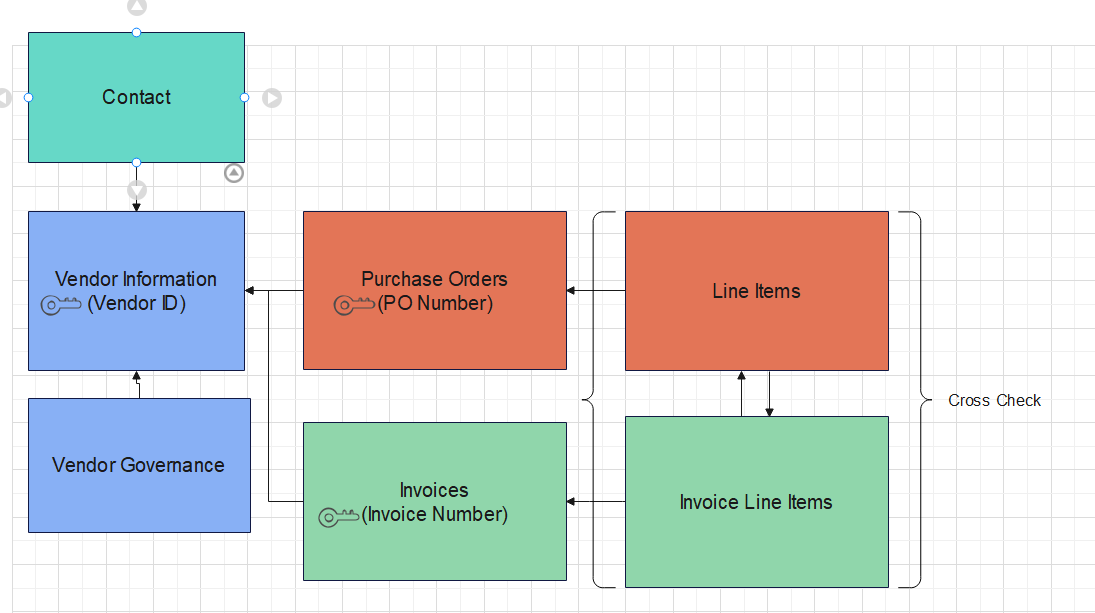

The 10 Key Benefits of Accounts Payable Automation

Dutch Fintech Navigator by hollandfintech - Issuu

5 reasons to automate your factoring back office - Klippa

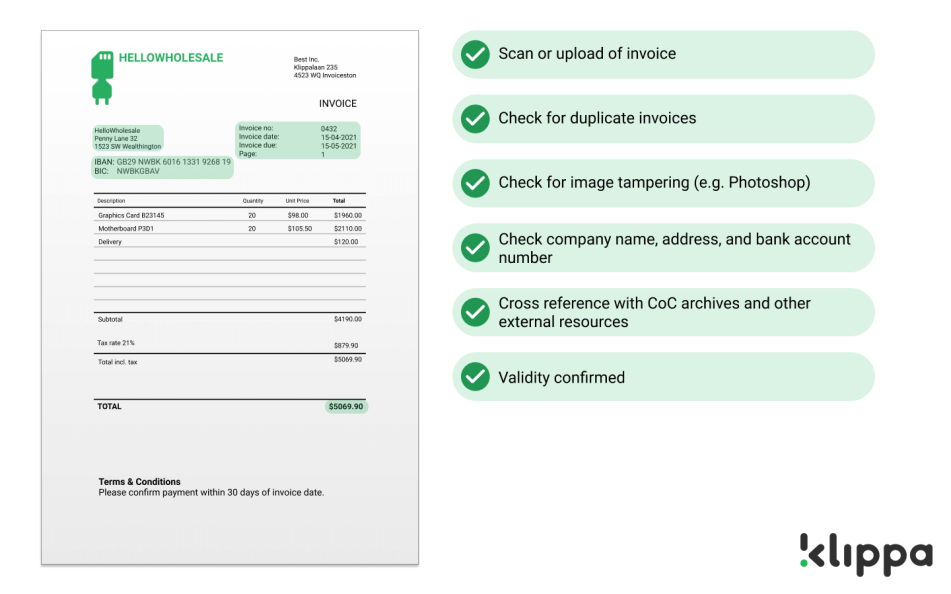

What is Invoice Capture?

Back-Office Automation: Benefits & Best Practices - Pipefy

Klippa on LinkedIn: Benefits of Automated Invoice Processing

A Quick Guide to RPA Implementation in 2021

Benefits of automating your loyalty campaign back office - Klippa

5 reasons to automate your factoring back office - Klippa

Klippa on LinkedIn: Benefits of Automated Invoice Processing

Recomendado para você

você pode gostar

![Best Free Invoice Templates [Word, Excel, PDF] - Hubstaff Blog](https://hubstaff.com/blog/wp-content/uploads/2018/12/Invoice-templates@2x.jpg)

![CODE] LEGENDARY EREIN ANIME ADVENTURES ROBLOX](https://i.pinimg.com/736x/4d/08/85/4d088549fc7afe326282b1a32223c8e9.jpg)