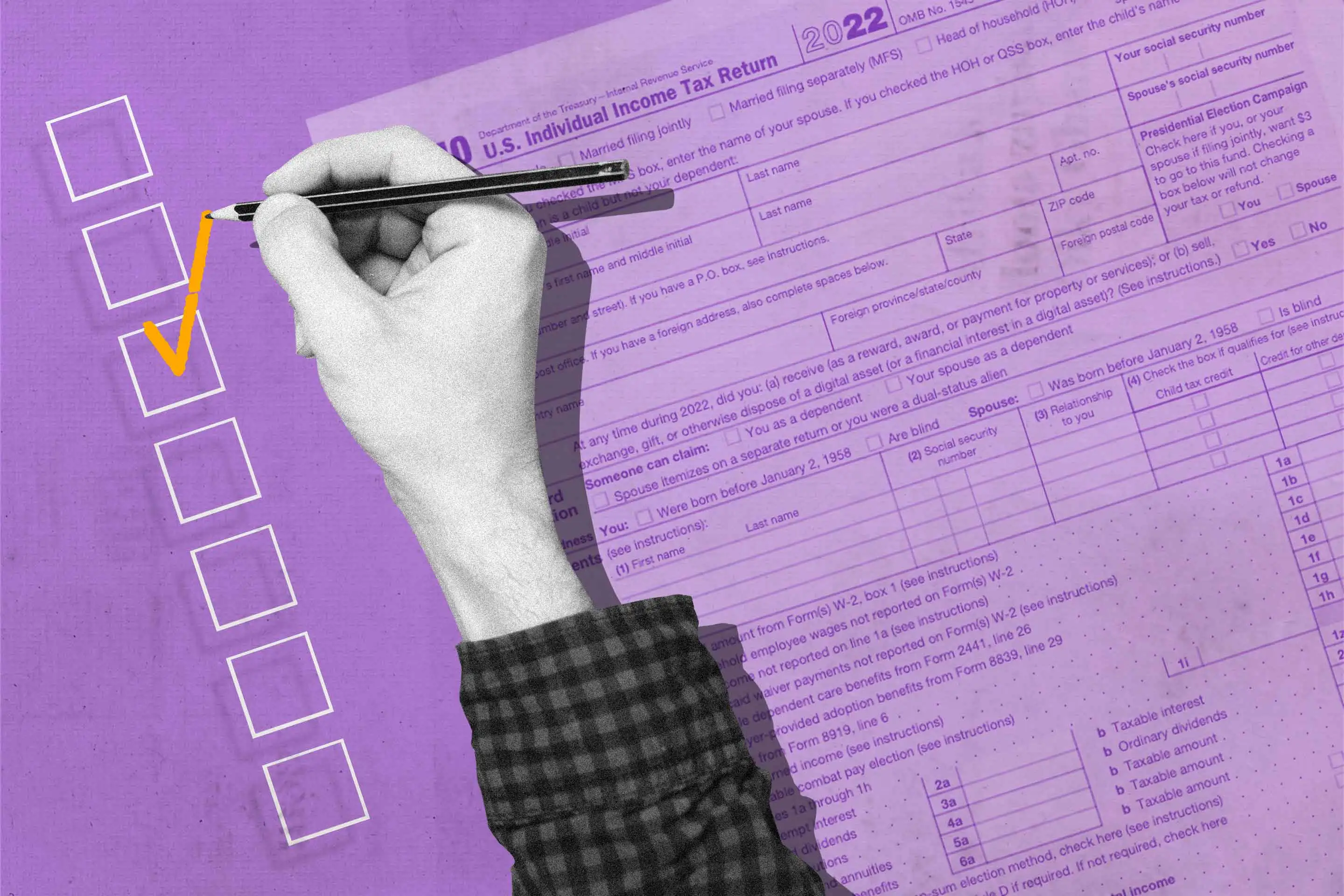

FICA Tax in 2022-2023: What Small Businesses Need to Know

Por um escritor misterioso

Last updated 11 novembro 2024

FICA taxes are paid by all workers. The FICA taxes are paid based on your total income from all sources. Here is what small businesses need to know.

2023 IRS Form W-2: Simple Instructions + PDF Download

What are FICA Taxes? 2022-2023 Rates and Instructions

DeWine announces $1 billion in additional, one-time spending under

FICA Tax in 2022-2023: What Small Businesses Need to Know

A guide to small business tax brackets in 2022-2023

How the Big Social Security Changes in 2023 Affect You

FICA Tax: What It is and How to Calculate It

Payroll Taxes in 2023: What You Need To Know - Justworks

Social Security and Medicare Taxes in 2023: What's New and What's

2024 State Business Tax Climate Index

Here Are the Federal Income Tax Brackets for 2022 and 2023

Recomendado para você

você pode gostar