Tackling the tax code: Efficient and equitable ways to raise revenue

Por um escritor misterioso

Last updated 20 setembro 2024

This book presents new proposals for a value-added tax, a financial transactions tax, wealth and inheritance taxes, reforming the corporate and international tax systems, and giving the Internal Revenue Service the resources it needs to ensure that tax laws are better enforced and administered.

Six ways that governments can drive the green transition

LSE–Lancet Commission on the future of the NHS: re-laying the

What is Windfall tax? How does it affect ONGC, Reliance & other

Difference Between a Tax Audit and Financial Audit - Vakilsearch

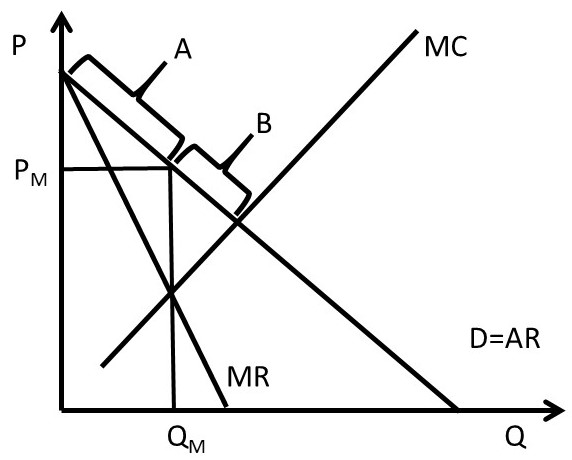

Taxation: Deficit Spending and Taxation: Examining the Trade offs

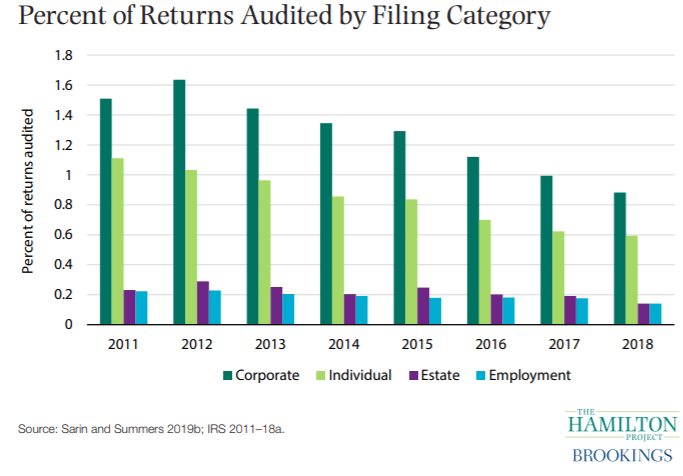

The Hamilton Project in 2020 – A Year in Figures - The Hamilton

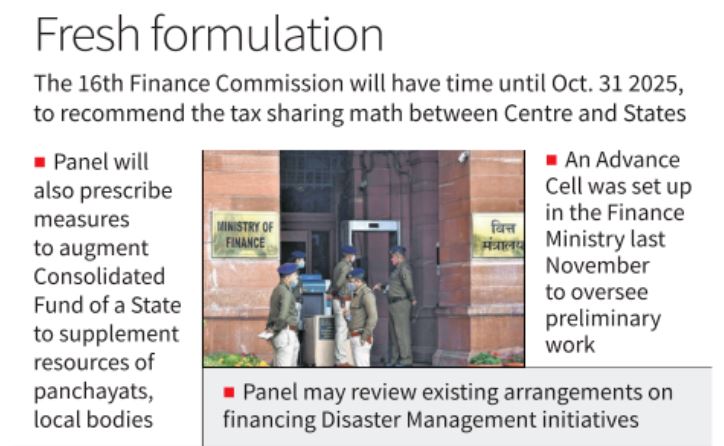

Finance Commission - Issues related to devolution of resources

Tackling the tax code: Efficient and equitable ways to raise

How do taxes affect income inequality?

Recomendado para você

você pode gostar