Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Last updated 11 novembro 2024

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

California FTB and IRS Estimated Tax Payments - Abbo Tax CPA - San Diego CPA

What You Need to Know About Underpayment of Tax Penalties

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Tax Penalties and Interest: IRS Tax Penalty Details For Many Situations

Use These 3 Tips to Avoid Estimated Tax Penalties - SH Block Tax Services

Why do I owe a penalty and interest and what can I do about it?- TAS

How To Make Quarterly Estimated Tax Payments For Ministers - The Pastor's Wallet

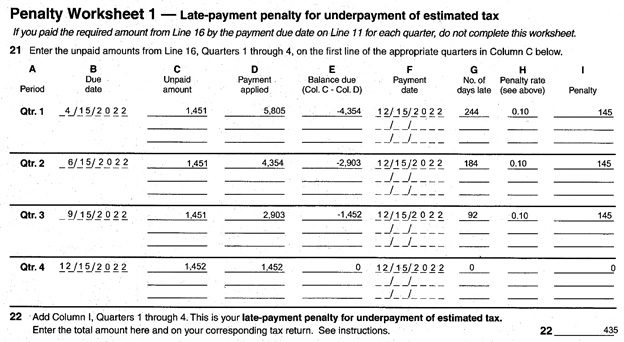

All About Estimated Tax Penalty Rate & How To Avoid It

How Retirees Can Avoid Paying Quarterly Taxes Without Getting Penalized – Financial Success MD

Time Is Running Out To Reduce 2022 Tax Burden Using PTE Payments - U of I Tax School

Estimated Tax Payments - Don't Sweat The Small Stuff

Underpayment Penalty? Turbo Tax tells me I may owe?

For those who pay estimated taxes, second quarter June 15 deadline approaches – Larson Accouting

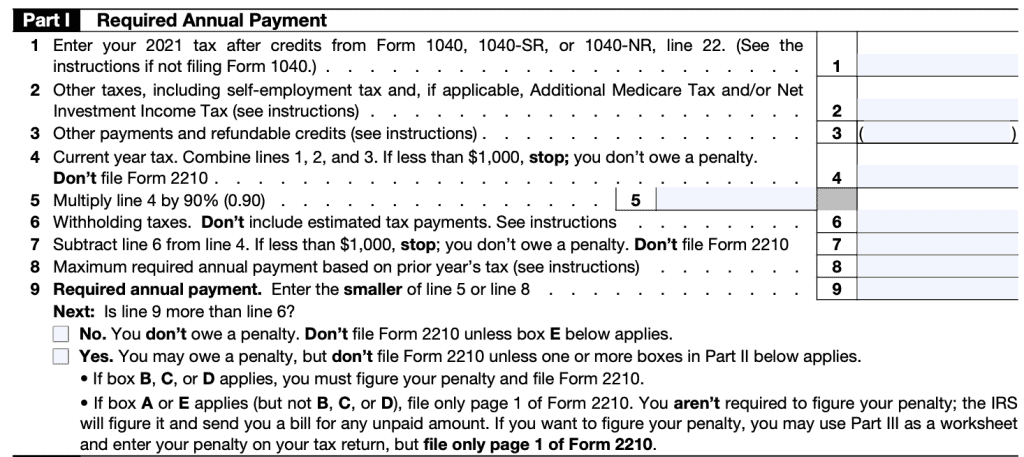

IRS Form 2210 Instructions - Underpayment of Estimated Tax

Find Out The Penalty For Underpayment Of Quarterly Estimated Tax

Recomendado para você

você pode gostar

![Fui bater uma e parei pra assistir Evangelion 1.11 Você (não) Está Só minutos] 41 minutos)](https://imgb.ifunny.co/images/3157fe518932fc06767b0582c46ffa3098b570157eee78069815465e35fc20d9_1.jpg)