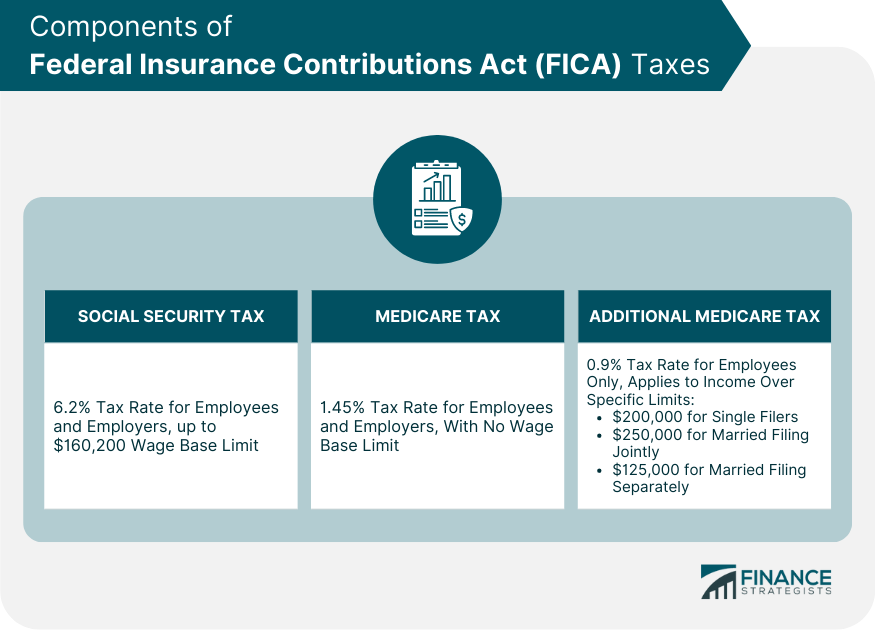

Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Last updated 30 setembro 2024

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Payroll tax in Texas: What employers need to know

Federal Insurance Contributions Act (FICA)

What Is the FICA Tax?, Retirement

What is a payroll tax? Payroll tax definition, types, and

How An S Corporation Reduces FICA Self-Employment Taxes

What Is FICA Tax Understanding Payroll Tax Requirements

Learn About FICA Tax and How To Calculate It

The Evolution of Social Security's Taxable Maximum

Understanding Your W-2

Howard & Company, CPAs, P.A.

Recomendado para você

você pode gostar

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)