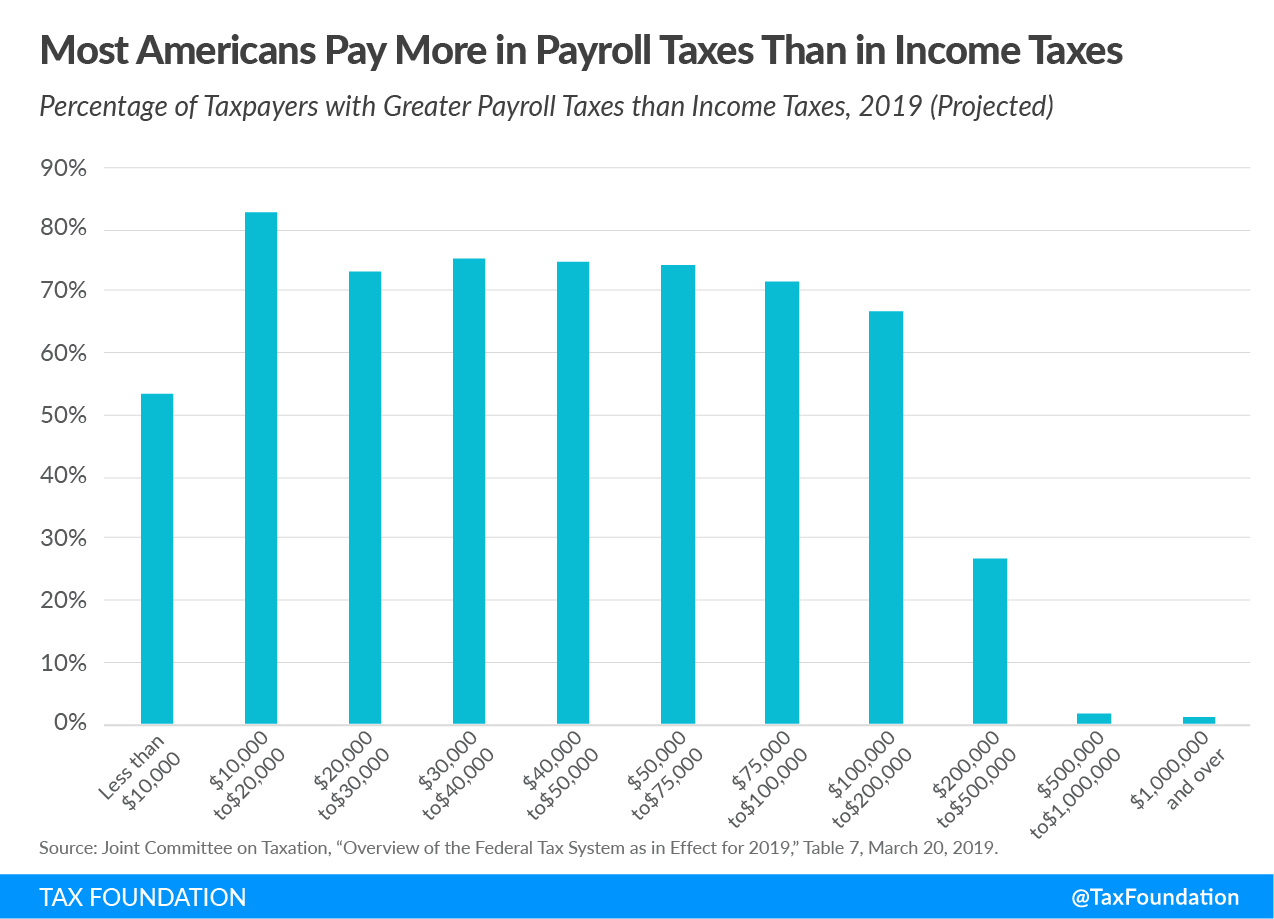

Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 10 novembro 2024

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

Maximum Taxable Income Amount For Social Security Tax (FICA)

What Are FICA Taxes? – Forbes Advisor

Overview of FICA Tax- Medicare & Social Security

2023 FICA Tax Limits and Rates (How it Affects You)

Payroll Tax Definition, What are Payroll Taxes?, TaxEDU

Social Security, Medicare & Government Pensions - Legal Books - Nolo

What Is FICA Tax? A Complete Guide for Small Businesses

What Is FICA? Is It The Same As Social Security?

Why do FICA-SS and FICA-MC show as ZEROS on my Tax Deposit and 941

What is FICA

FICA Tax Exemption for Nonresident Aliens Explained

FICA and Withholding: Everything You Need to Know - TurboTax Tax

What is FICA and why does it matter for Social Security, Medicare

How to Pay Social Security and Medicare Taxes: 10 Steps

Medicare Tax: Current Rate, Who Pays & Why It's Mandatory

Recomendado para você

você pode gostar