28/36 Rule: What It Is, How to Use It, Example

Por um escritor misterioso

Last updated 11 novembro 2024

:max_bytes(150000):strip_icc()/twenty-eight-thirty-six-rule.asp_final-8aea4a4d663140c1865477bb578fcddd.png)

The 28/36 rule calculates debt limits that an individual or household should meet to be well-positioned for credit applications. It measures income against debt.

What Percent Of Income Should Go to Mortgage? — Budgetry

28/36 Rule AwesomeFinTech Blog

How Much of My Income Should Go to My Mortgage?

Use the 28/36 rule to find out how much house you can afford by Chris Menard

What is the 28/36 rule for home affordability?

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

Debt-to-Income (DTI) Ratio: What's Good and How To Calculate It

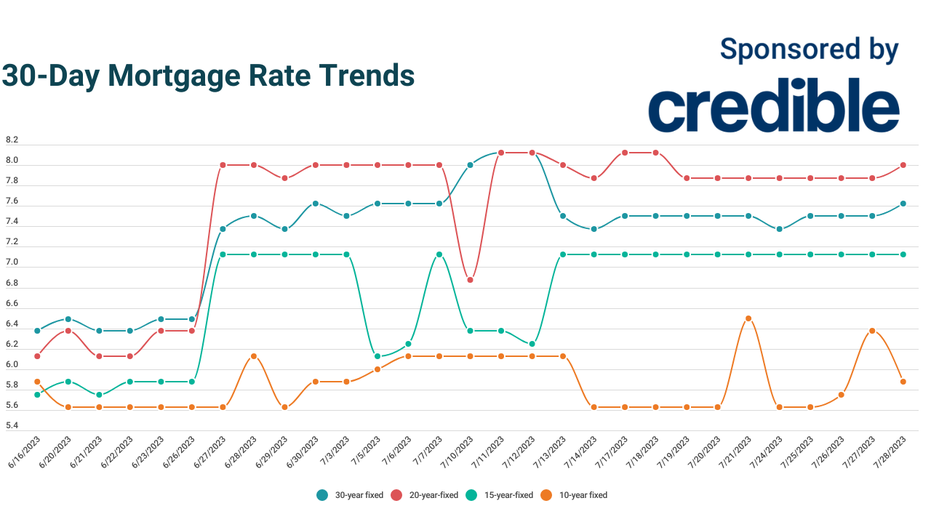

Today's lowest mortgage rate? 10-year terms at 5.875%

36 28 rule|TikTok Search

Use the 28/36 Rule to Decide Whether You Can Afford a Mortgage

Recomendado para você

você pode gostar

![Rule 63 [CHRISTMAS UPDATE] - Roblox](https://tr.rbxcdn.com/dfbdb6bb1c9e4e34a21e8efeb745c84b/500/280/Image/Jpeg)