Requesting FICA Tax Refunds For W2 Employees With Multiple Employers

Por um escritor misterioso

Last updated 24 setembro 2024

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax ove

Stock-based compensation: Back to basics

3.03 - Calculating Box Totals on Form W-2

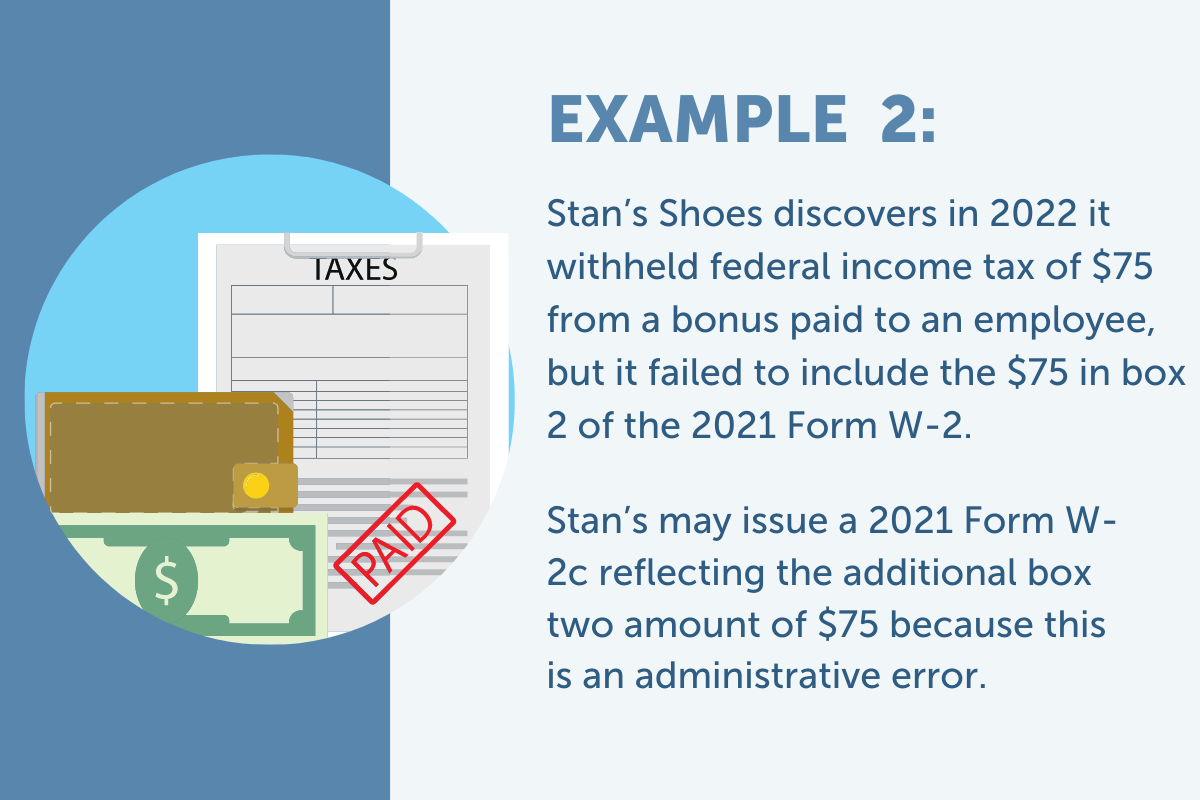

How to Avoid W-2 Form Errors

W-2s May Need to Be Corrected Due to the FFCRA

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

Form W-2 - Wikipedia

Form W-2 Box 12 Codes Codes and Explanations [Chart]

What is a W2 Form and What is a W2 Form For? - ShiftPixy

Recomendado para você

você pode gostar