Federal Insurance Contributions Act (FICA): What It Is, Who Pays

Por um escritor misterioso

Last updated 20 setembro 2024

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

The Federal Insurance Contributions Act (FICA) is a U.S. payroll tax deducted from workers

Federal Insurance Contributions Act (FICA)

The Federal Insurance Contributions Act (FICA) - Xledger United States

The ABCs of FICA: Federal Insurance Contributions Act Explained

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

What is FICA (Federal Insurance Contributions Act)? (2023)

Federal Insurance Contributions Act (FICA)

What are FICA Taxes? Social Security & Medicare Taxes Explained

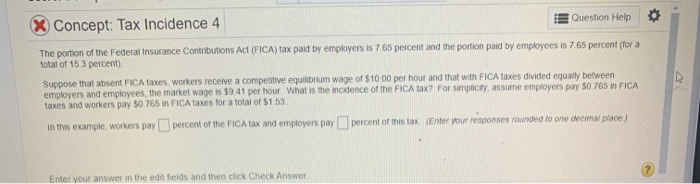

Solved Concept: Tax Incidence 4 Question Help The portion of

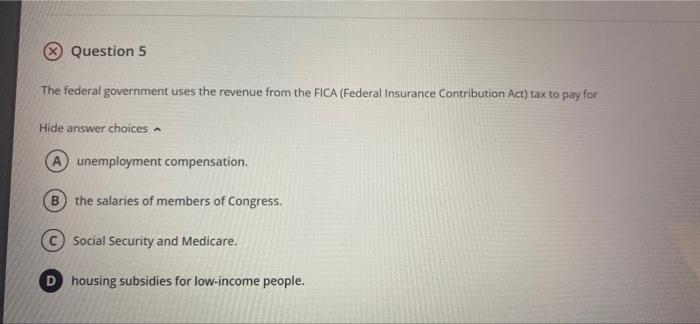

Solved Question 5 The federal government uses the revenue

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023)

Recomendado para você

você pode gostar

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)