Enterprise Risk Management and Performance Improvement: A Study with Brazilian Nonfinancial Firms

Por um escritor misterioso

Last updated 10 novembro 2024

25)

Purpose – This research aimed to study the relationship between Enterprise Risk Management (ERM) and performance improvement.Design/methodology/approach – A questionnaire was used as an instrument of data collection that was passed to managers of nonfinancial companies listed among the 500 largest and best firms in Brazil. The data from this study were analyzed with descriptive statistics and multivariate analysis of correlation and association.Findings – The results showed that the main drivers of risk management were regulation, stakeholder demands, and business competitiveness. Among the practices that have been used, managers spotlight the utility of basic methods, more subjective, while technical methods, more quantitative, were of secondary importance. It was evidenced that the risks were weighted in the main activities of the organization. As a result, it was demonstrated that improved performance is associated with the maturity level of risk management and the level of stakeholders’ involvement in risk management.Research limitations/implications – Other researches could examine how this process was developed in other countries and expand the number of organizations studied.Practical implications – This study provides empirical evidence about theorist assumptions about the relationship between ERM and performance improvement.Social implications – This study demonstrates the importance of human aspects for the processes of risk management and how external factors can influence this process.Originality/value – It gives a broader and deeper comprehension of the process of risk management at nonfinancial firms in Brazil.

A better approach to financial risk management

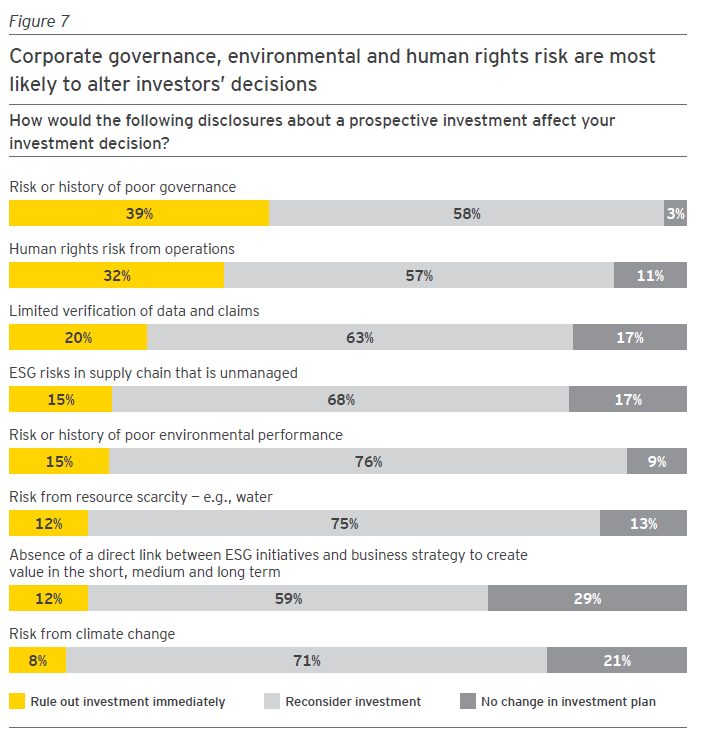

The Importance of Nonfinancial Performance to Investors

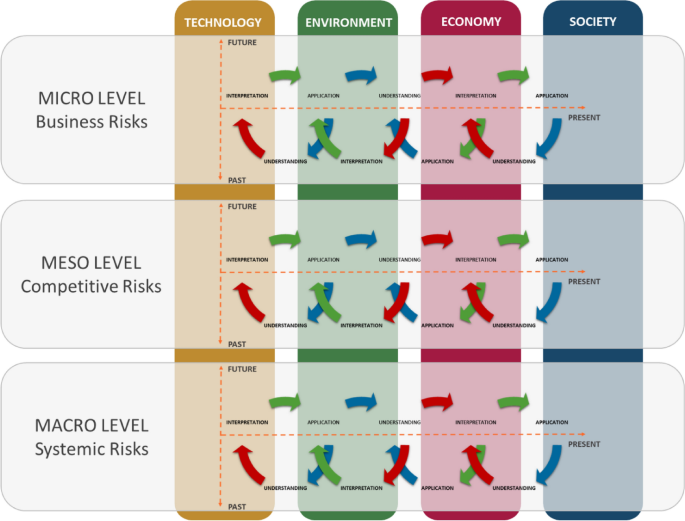

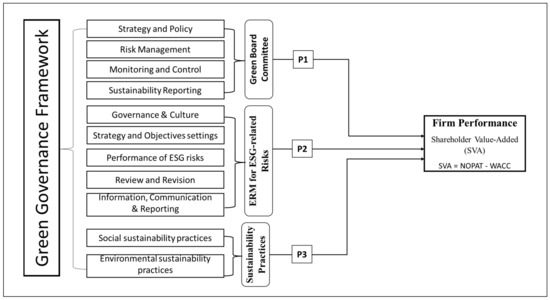

Flexibility and Resilience in Corporate Decision Making: A New Sustainability-Based Risk Management System in Uncertain Times

Highlight, take notes, and search in the book

Enterprise Risk Management: Today's Leading Research and Best Practices for Tomorrow's Executives

How new COSO guidance will help with internal control over ESG reporting

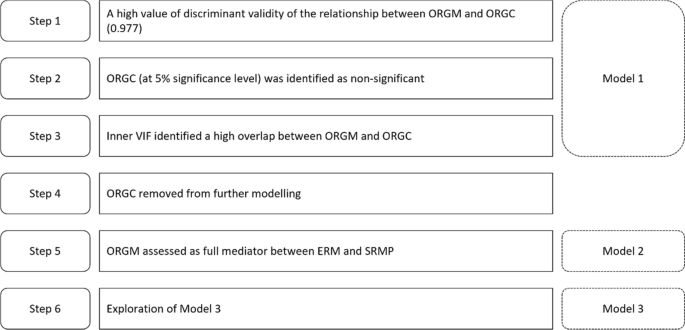

Exploring the indirect links between enterprise risk management and the financial performance of SMEs

Everything you need to know about ServiceNow IRM - Plat4mation

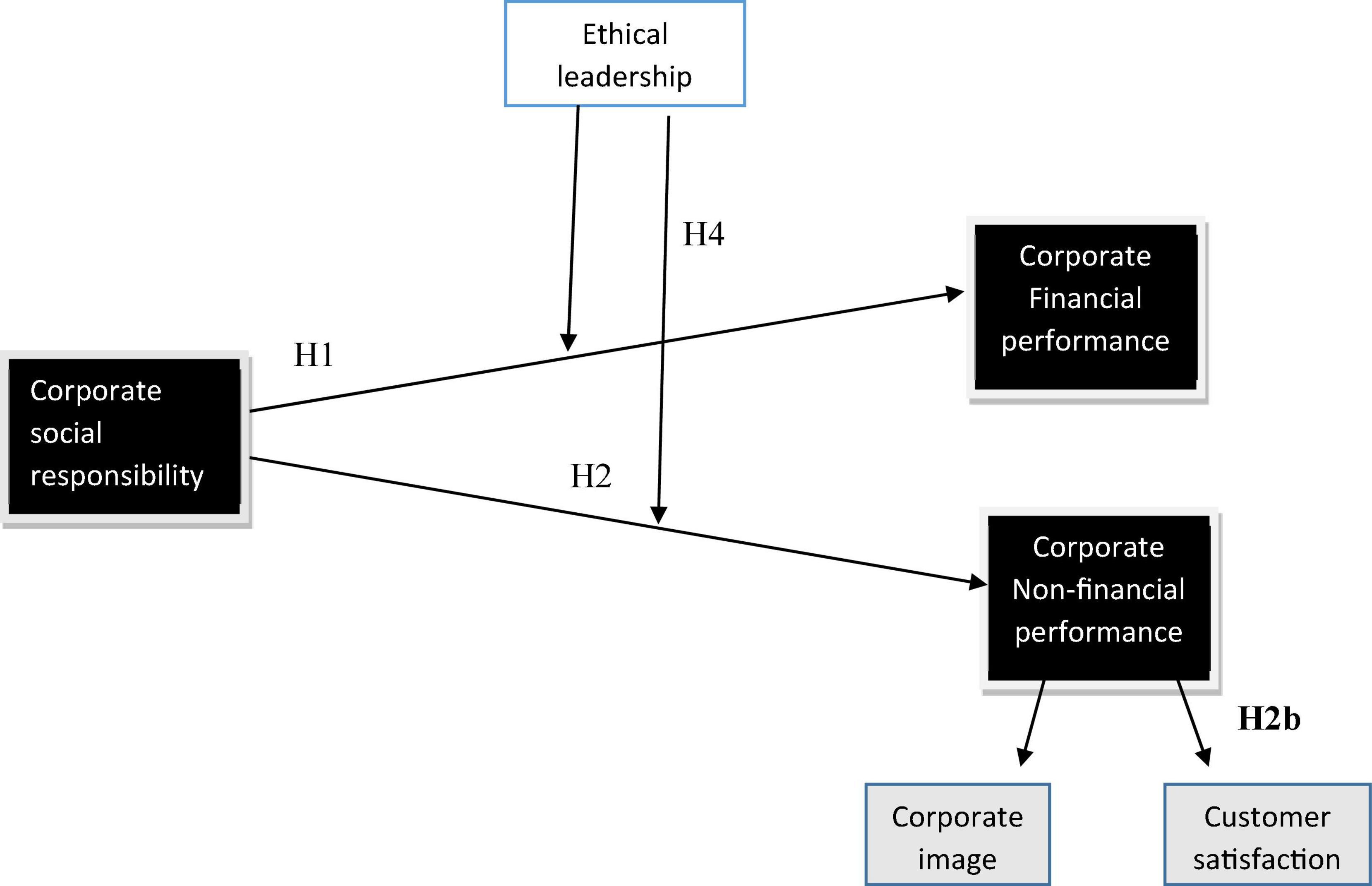

Frontiers How Corporate Social Responsibility Boosts Corporate Financial and Non-financial Performance: The Moderating Role of Ethical Leadership

Risk & Resilience Insights

PDF) Enterprise Risk Management and Firm Value: The Case in Emerging Market

PDF) Enterprise Risk Management and Corporate Performance in Nigerian Non-Financial Quoted Companies

Sustainability, Free Full-Text

Enterprise Risk Management and Firm Value: Evidence from Brazil: Emerging Markets Finance and Trade: Vol 55, No 3

Transforming enterprise risk management for value in the insurance industry

Model risk management tools, Model risk

Recomendado para você

você pode gostar