Are Gift Cards Taxable to Employees?

Por um escritor misterioso

Last updated 10 novembro 2024

Are gift cards taxable? If your business purchases gift cards for employees, make sure you’re not missing this important reporting step.

FAQ: Are Gift Cards for Employees a Tax Deduction?

Employee Gifts - Tax Implications of Giving Gifts to Staff, Blog

Q&A: Gift card instead of a cash bonus

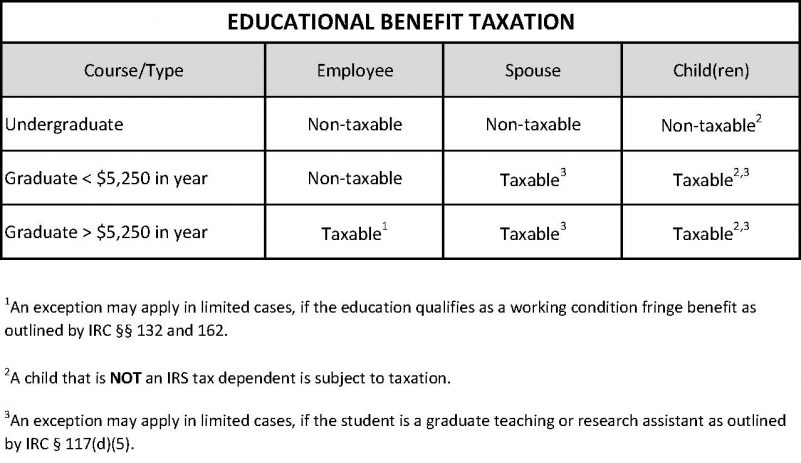

Are gift cards taxable employee benefits?

Taxable & Non-Taxable Benefits: Definition & Examples - Video & Lesson Transcript

Employee Gift Cards, Best in 2023

Giving Gifts to Employees? IRS Wants Its Share

Are Employee Gifts Taxable? What You Need to Know

Ask the Expert: Are All Gift Cards Taxable Income?

Are Gift Cards taxable, Tax on Gift Cards

Fringe Benefit Taxation – Tax Office

Recomendado para você

você pode gostar

:max_bytes(150000):strip_icc()/creative-gift-exhange-Word_Game_A-_Carol_Game-2000-569465249c73411d859075b35d0baced.jpg)